Market snapshot

- ASX 200: +0.7% to 8,124 points (live prices below)

- Australian dollar: flat at 62.50 US cents

- S&P 500: +1.1% at 5,931 points

- Nasdaq: +0.9% to 21,289 points

- FTSE: -0.3% to 8,085 points

- EuroStoxx: -0.2% to 501 points

- Spot gold: +0.2% to $US2,625/ounce

- Brent crude: +0.1% to $US73.00/barrel

- Iron ore: -0.1% to $US103.65/tonne

- Bitcoin: -1.5% to $US95,123

Prices current around 11:00am AEDT

Live updates on major ASX indices:

Who is DAZN, Foxtel’s new owner?

DAZN ( pronounced Da-Zone) is a privately owned media empire which streams to 200 different markets around the world and includes major sports such as European football, boxing, Formula 1, NBA, NFL and MMA among its products.

It was founded in 2016 by Sir Leonard Blavatnik.

Sir Len, as he is known, grew up in the then Soviet controlled city of Odessa and made his initial fortune amidst the collapse of the Soviet Union taking up large stakes in privatised aluminium and oil companies.

Forbes recently valued his net worth at $US32 billion with assets including the ownership of the bulk of the Warner Music Group via his private investment business Asset Industries.

Under the deal, Foxtel will maintain its head office in Artarmon.

“We are committed to supporting and investing in Foxtel’s television and streaming services, across both sports and entertainment, using our world-leading technology to further enhance the viewing experience for customers,” DAZN CEO Shay Segev said.

“We are also committed to using our global reach to export Australia’s most popular sports to new markets around the world, just as we have done with the NFL, and we will continue to promote women’s and under-represented sports,” he said.

Foxtel says sale will allow it to compete

Foxtel says its $3.4 billion sale to UK sports streaming business DAZN will strengthen the business and allow it to compete with local and international streamers.

Foxtel Group CEO Patrick Delany said the deal was a significant step forward in Foxtel’s transformation as a sports and entertainment streaming provider.

Mr Delany will continue as CEO following DAZN’s acquisition.

“DAZN is a global leader in sports, and being part of a dynamic global streaming group will create new growth options for the Foxtel Group and new value for subscribers and partners,” Mr Delany said.

“When the transaction completes next year, DAZN’s ownership will provide us with access to global reach and the infrastructure and technology to support our continued transformation and allow us to continue to compete effectively with the global streaming giants.”

News Corp (65% stake) and Telstra (35% stake) have been exploring ways of getting out of Foxtel for years as competition from new streaming services, both local and international, heated up.

A plan to list Foxtel fell apart in 2016 as subscriber numbers tumbled and another plan to float the business in 2021 also failed due to lack of interest from the market.

Foxtel has 1.4 million customers on its heritage cable TV business and another 3.2 million subscribers on its newer streaming platforms such as Kayo Sports and Binge.

While Foxtel earned $200 million last year on revenues of $3 billion, it is encumbered by about $1.2 billion in debt as costs, such as sports broadcast rights, skyrocketed in recent years.

At 11:30am AEDT News Corp shares were up 0.9% to 27.86 and Telstra had edged up 0.1% to $3.99.

ASX opens 0.7% higher

The ASX is off to a cracking start, opening 0.7% higher.

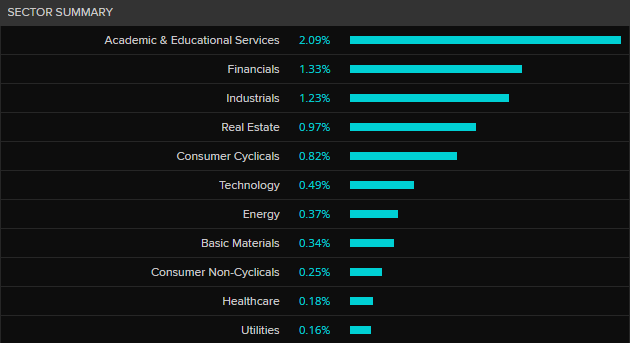

Gains are being made across the board with the industrial and financial sectors leading the way.

The banks are all higher with the CBA up 1.8%

The miners are mixed after another fall in iron ore prices on Friday – BHP (-0.4%) and Rio Tinto (-0.3%) have slipped while Fortescue is up 0.5%).

News Corp is up 0.9% and Telstra is up 0.4% after they announced they would be selling their jointly owned Foxtel pay- TV business for $3.4 billion.

The biggest gain on the ASX 200 so far is uranium miner Deep Yellow which is up 7%.

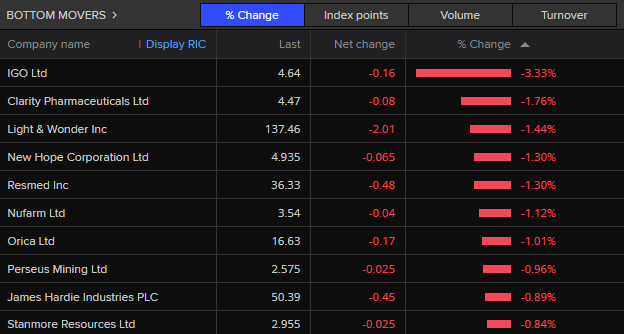

The biggest loser so far is lithium miner IGO (-3.2%) on a production update that include the news it would be suspending its annual dividend.

Foxtel sold for $3.4 billion

Pay channel Foxtel has been sold by its two shareholders News Corp and Telstra for $3.4 billion.

The new owner will be the British sports streaming platform DAZN Group.

The transaction is expected to be finalised later next year.

News and Telstra started Foxtel in 1995 with 20 channels, but it has struggled in recent years due to competition from other online streaming channels and the escalating cost of buying sports broadcast rights.

New French nuclear reactor starts, 12 years late, 300% over budget

The first electrons started flowing from France’s new Flamanville 3 nuclear reactor over the weekend.

The reactor in Normandy, right on the French Manche/English Channel coast, produces 1.6 gigawatts, making it the largest in France and one of the largest in the world.

It’s the first nuclear reactor to be connected to the French grid since 1999.

Despite being built on a brownfield site next to two other reactors, the project has been beset with problems.

Construction started in 2007 and was due to be completed in 2012.

The thirteen-year blowout saw the original budget of 3.3 billion euros ($5.5 billion) escalate to 13 billion euros ($22 billion), although the French Court of Audit found the total cost is more like 19 billion euros ($32 billion).

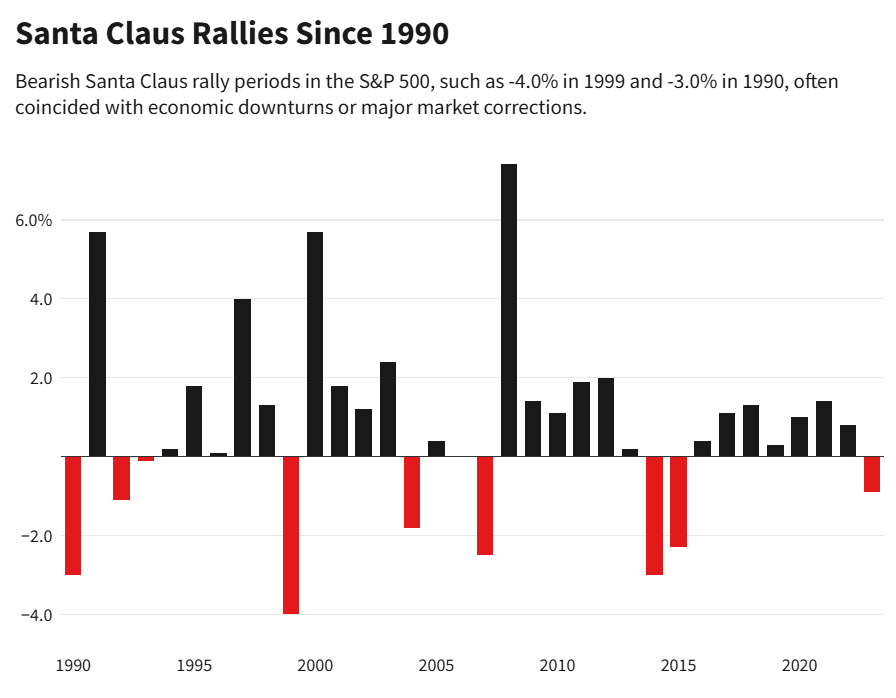

Santa Claus Rally: Fact or Fiction?

So just what is and when is this Santa Claus period that so excites the market?

When does the “Santa rally” start and end?

The etymology of the phrase is credited to the founder of the US-based Stock Trader’s Almanac Yale Hirsch who defined it as, ” the last five trading days of the year combined with the first two of the following year”.

So, from a purist’s point of view, we haven’t opened the rally window just yet.

December 24 will be the S&P 500’s fifth last trading day of the year.

What happens?

The Almanac notes since 1950, the Santa Rally has delivered an average gain on the S&P 500 of 1.3%

“Despite all of the high frequency trading and algorithmic trading and the velocity of the market these days…patterns [like the Santa Claus rally’ continue to persist,” Jeffrey A. Hirsch, Yale’s son and current editor of the annual Stock Trader’s Almanac noted.

Is it an immutable law of investing?

Nope. There are plenty of times the sleigh has crashed such as 1999 when the S&P 500 dropped 4%.

There was only a minor bingle last year when the market lost 0.9%.

Why does it happen?

Assuming it is a real thing, Investopedia lists a number of unproved theories about the “Santa Claus Rally”.

These include:

- increased holiday shopping

- seasonal optimism

- end-of-tax-year considerations

- less institutional trading since many cut back on activity during the holidays.

Is that all?

The Santa Claus period, when combined with the following first five trading days of January and the performance of January overall, is also seen as a harbinger for the year.

When those three indicators are positive, the year has ended higher more than 90% of the time in the past 50 years, according to the Almanac.

As always, nothing in this blog should be seen as investment advice — particularly when the word “harbinger” is used.

Loading

Auction clearances take a dive

Perhaps it’s no surprise, but it wasn’t a great weekend to sell a home, particularly in the big markets of Sydney and Melbourne.

On pretty low volumes, around half the Sydney properties up for auction were passed in.

Melbourne fared slightly better with a clearnace rate of 62% according to the property portal Domain.

This week: It’s Christmas

A much shorter than usual diary for this week — basically there’s nothing much apart from some second tier US data in coming days.

None of them worth as much as a keystroke.

Fortunately, the RBA has come up with a stocking stuffer.

It will release its board minutes (Tuesday) from earlier this month.

But don’t rip through it too quickly, savour it like a Christmas feast, as the next data drops will be house prices on January 2 and the monthly inflation indicator out on January 8. Sigh.

ASX set to open higher after Wall St rally

After enduring its worst week since before the November presidential election, Wall Street at least finished Friday on a positive note.

The big three indices — the S&P 500, the Dow and the Nasdaq — all gained more than 1% after marginally weaker-than-expected inflation data eased concerns about future interest rate cuts from the Fed.

Before the Personal Consumption Expenditure (PCE) Price Index — the Fed’s preferred measure of inflation — came in showing a 2.4% rise in November, the market had glumly pushed back its expectations of the next cut to December 2025.

It’s now priced in for March, with a third cut in the series before October.

The late session surge looks like flowing through to the local market with the ASX 200 futures up 0.2%.

That will be a relief given the index dropped almost 3% last week, its worst weekly performance since April.

European markets missed the inflation news and closed lower, with the Eurostoxx index weighed down by the capitulation of the Danish drug maker, Novo Nordisk (-21%) on disappointing results on its next generation anti-obesity drug.

President-elect Donald Trump’s demands that Europe buy more US gas and oil, or face tariffs didn’t help the sentiment either.

Oil prices were little changed on Friday, ending the week down around 2.5%.

Gold was also a beneficiary of the soft US inflation data gaining around 1% on the day but was 0.9% down on the week.

Bitcoin remained under $US100,000 after slipping last week on Federal Reserve chairman Jerome Powell’s comments that the bank is not allowed to own any digital currency, nor was he looking at a change to the law to make it possible.

Good morning

Good morning and welcome to another week on the ABC markets and finance blog.

Stephen Letts from ABC business team limbering up for a blow-by-blow coverage of the day’s events, where every post is hopefully a winner, but none should be construed as financial advice.

In short, futures trading points to a 0.2% rise on the ASX 200 this morning.

It is perhaps not a Christmas miracle, but somewhat lucky nonetheless there will be any trading at all today.

The ASX’s CHESS software crashed on Friday meaning the transactions going back to Wednesday couldn’t be cleared, leaving them in limbo until someone figured out how to reboot the 30-year-old system late Sunday afternoon.

Fingers crossed for today.

As always, the game’s afoot, so let’s get blogging.

Market snapshot

- ASX 200 futures: +0.2% to 8,079 points

- Australian dollar: +0.2% to 62.50 US cents

- S&P 500: +1.1% at 5,931 points

- Nasdaq: +0.9% to 21,289 points

- FTSE: -0.3% to 8,085 points

- EuroStoxx: -0.2% to 501 points

- Spot gold: +1.0% to $US2,621/ounce

- Brent crude: +0.1% to $US72.94/barrel

- Iron ore: -0.1% to $US103.65/tonne

- Bitcoin: -1.8% to $US94,839

Prices current around 7:30am AEDT

Live updates on major ASX indices: