You don’t always need a recession to send stocks into a tailspin

Article content

Article content

Article content

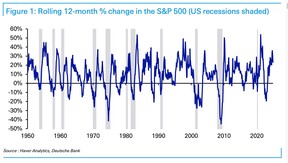

The last time the S&P 500 posted back-to-back annual returns above 20 per cent was in the 1990s, and this raises the question — how long will it last?

Recession is the most common driver of significant losses in the stock market; you only have to look as far back as 2020 and 2008 to see that. But today with no signs of a slowdown on the horizon and leading indicators looking up, the good times should just keep rolling, right?

Advertisement 2

Article content

Not necessarily, says a report from Deutsche Bank Research. There are times when markets have toppled into a serious decline without a recession, and though they are “pretty infrequent,” their researchers found eight examples in the past 75 years that reveal common themes.

Sometimes it doesn’t take a recession, it just takes the fear of a recession.

That’s what happened in 2022, when the Federal Reserve began to clamp down on soaring inflation with aggressive interest rate hikes. Growth slowed as well, with GDP in the United States dropping from 5.7 per cent in the fourth quarter of 2021 to 1.3 per cent a year later.

A U.S. recession became the consensus forecast among economists and that’s all it took. The S&P 500 fell by 25 per cent from peak to trough.

“Ultimately, this episode is a good example of equities selling off based on fears of a recession, rather than the reality of one,” said Henry Allen, Deutsche Bank macro strategist.

Now let’s travel back to Black Monday in 1987 when the S&P 500 fell 20 per cent in one day. The carnage on Oct. 19 was part of broader decline which saw the index lose 33 per cent in less than four months, said Deutsche.

Article content

Advertisement 3

Article content

Many of the factors behind that fall exist today and one of the big ones was concern about high valuations. When it peaked in August, 1987 the S&P 500 was up 39 per cent year over year.

Today, as Noah Solomon points out in his column for the Financial Post, the S&P 500 is at its highest multiple in the postwar era, except for the tech bubble in the late 1990s.

“The four largest debacles in the history of modern markets were all preceded by peak valuations,” says Solomon.

In 1987, there were also fears about trade and budget deficits, both on the minds of investors today as president-elect Donald Trump prepares to enter the White House.

The one component that existed then and not now was a hawkish Fed.

One of the biggest falls outside of a recession was in 1961, when the S&P 500 shed 28 per cent. Again there were growing concerns about extended valuations with the CAPE ratio hitting its highest level since 1937. Growth was slowing, but was far from contracting.

Deutsche says two themes emerge from its examples: Slowing growth raises fears of recession, even if there isn’t one, and the Fed tightens monetary policy.

Advertisement 4

Article content

“So if growth remains strong and the Fed don’t start hiking rates again, it’s not implausible that elevated valuations continue for some time,” wrote Allen.

“But history demonstrates that if signs of a slowdown do emerge or rate hikes move back on the table, then it’s possible for equities to experience a notable decline, even without a recession.”

Sign up here to get Posthaste delivered straight to your inbox.

“We don’t need anything they have,” Trump said of Canada on Tuesday, characterizing the trade deficit as a subsidy. “We have more than they have.”

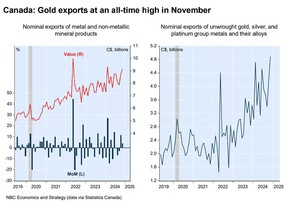

Canada’s exports to America rose 6.8 per cent in November, and imports increased 4.1 per cent. Our southern neighbour is by far our largest trading partner, accounting for 76 per cent of exports and 64 per cent of imports.

Oil, gas and metals mainly drove gains in November. Copper ore shipments surged almost 39 per cent and exports of gold/silver/platinum soared 21 per cent to an all-time high of $4.9 billion, said National Bank of Canada.

Advertisement 5

Article content

- U.S. markets will be closed today to observe a National Day of Mourning for former President Jimmy Carter.

- Today’s Data: United States wholesale trade

- Earnings: Aritzia Inc.

Career change is now a defining feature of modern working life, with 42 per cent of Canadians contemplating changing jobs. But before you take the plunge, there are financial implications you need to consider. Lynn MacNeil outlines some practical steps to take so that your career transition aligns with your long-term financial goals. Read more

Calling Canadian families with younger kids or teens: Whether it’s budgeting, spending, investing, paying off debt, or just paying the bills, does your family have any financial resolutions for the coming year? Let us know at [email protected].

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Advertisement 6

Article content

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Recommended from Editorial

-

Millennials overtake baby boomers on debt for the first time

-

Canada’s congestion ‘crisis’ is costing billions

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content