(Bloomberg) — Brazilian companies are buying back stocks at the fastest pace in almost two decades as higher interest rates sink the outlook for equities in Latin America’s largest economy.

Most Read from Bloomberg

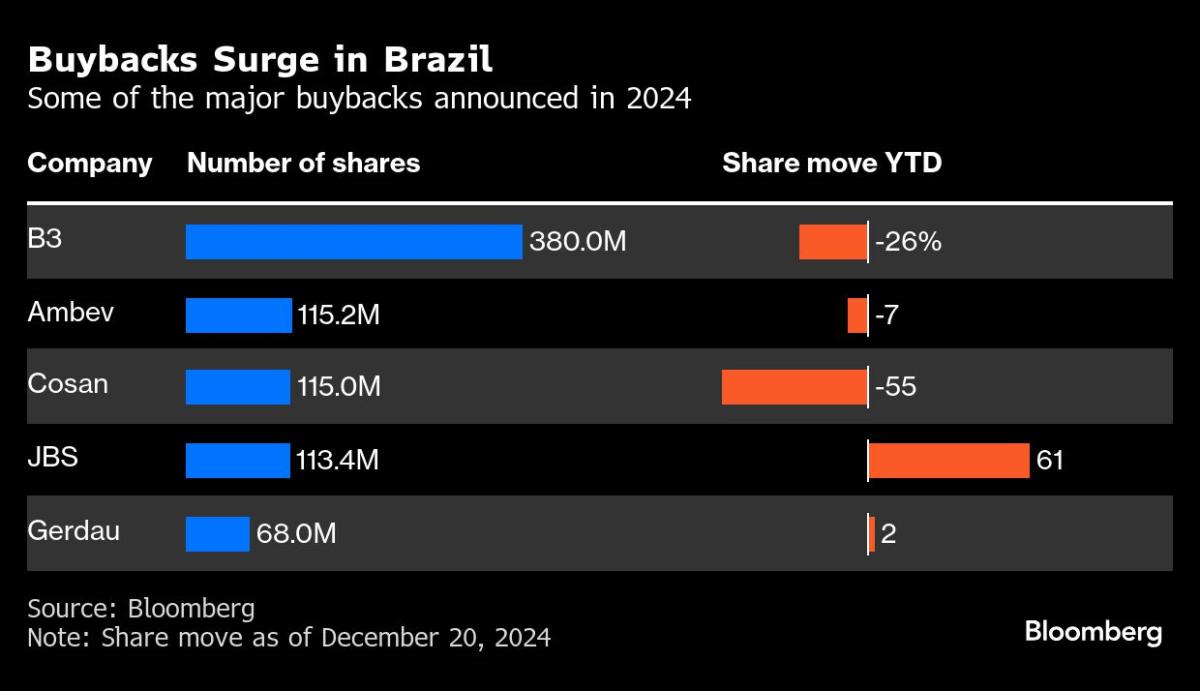

Companies listed in the benchmark Ibovespa index announced at least 54 stock buybacks this year, almost double the amount seen in each of the previous two years and the most since 2008, according to data compiled by Bloomberg.

Stock exchange operator B3 SA, lender Banco BTG Pactual, sugar conglomerate Cosan SA and brewing giant Ambev SA are among firms which recently announced they were scooping up shares in the market.

A gloomy scenario for equities amid rising interest rates and growing doubts about the outlook for Brazil’s swelling budget deficit have weighed on local stocks, which are trading at around 20% discount from historical levels. The Ibovespa is down almost 10% year-to-date, one of the worst performances among major global benchmarks.

“Companies can make better use of capital by investing in buybacks, rather than expansions, which involve execution and financing risks,” says Tiago Cunha, an equity manager at ACE Capital.

Less Investment

A lack of clarity about economic policies, such as changes to the tax system, has also made it less attractive for companies to invest, further encouraging other uses of capital.

Data from Itaú BBA estimates that outstanding buyback programs, which include those announced in previous years, total some 78 billion reais ($12.7 billion.)

“The increase reflects an attractive valuation for listed assets,” says Daniel Gewehr, head of equity research at Itau BBA. “The lack of macroeconomic visibility amid high interest rates has postponed longer-term investment projects, which has contributed to this increase in both buybacks and dividends.”

In a written response to questions, B3 said “a distortion” in the price of its shares led to the decision to buy back equity, distributing profits to holders.

Dividends

The uncertainty around tax changes has pushed companies and investors to rush to get money out of Brazil, according to a government official who asked not to be named because the information is private.

The outflows have taken a toll on the currency, which sank this month before the central bank stepped in to stem the decline. Central bank Governor Roberto Campos Neto recently said policymakers are seeing an atypical currency outflow, adding that dividend payments were above average.

Petroleo Brasileiro SA, meatpacker Marfrig Global Foods SA and Ambev are some of the companies paying dividends in the last few days of 2024, according to data compiled by Bloomberg.